June 2025 Labour Market Snapshot

Monthly review of the current labour market in Canada’s electricity sector

The latest

Statistics Canada released the results of its June Labour Force Survey (LFS) on July 11, 2025, a key monthly indicator of the state of employment across Canada. The LFS provides insights into national, provincial, territorial and regional labour market conditions, including employment and unemployment rates.

This report summarizes the key findings of the June 2025 survey, with a particular focus on developments affecting the utilities sector. It also explores the broader economic context, including recent trade tensions, inflationary conditions and government policy responses.

Economic Context: Trade Tensions and Inflationary Pressures

On April 4, 2025, the United States imposed a 25% tariff on Canadian imports not covered under the Canada-United States-Mexico Agreement (CUSMA). The Trump administration further escalated trade tensions by applying tariffs of 25% on automotive and steel products, and 10% on energy and aluminum. These measures have drawn strong opposition from stakeholders in both countries, including within the electricity sector.

On June 4, the U.S. increased its tariffs on aluminum and steel to 50%, extending them to all countries except the United Kingdom, whose tariff remains at 25%. Canada, the largest supplier of steel and aluminum to the U.S., is particularly affected, accounting for half of U.S. aluminum imports in 2024 and nearly a quarter of steel imports in 2023.[1] [2] On July 10, President Trump threatened to impose a 35% tariff on all other Canadian imports as of Aug. 1.

In response to these developments, Canada imposed matching tariffs on most U.S. imports but later delayed their implementation until Oct. 16, 2025. The government intended to de-escalate tensions and provide Canadian industries—especially automotive, manufacturing and healthcare—time to adapt their supply chains. In June, employment in manufacturing, which includes electrical equipment and components, rose by 10,500 after four months of decline.

To cushion the impact on workers, the federal government implemented temporary enhancements to the Employment Insurance program, including higher regional unemployment thresholds, elimination of the waiting period for benefits, and broader eligibility criteria. Several provinces, including Ontario, Manitoba, and Quebec, have also rolled out tax deferrals, tax reductions, or direct financial aid to support affected businesses.

Building Economic Resilience: Interprovincial Trade Reform

To reduce Canada’s reliance on U.S. trade, the federal government has pledged to diversify and expand multilateral trade and enhance domestic economic integration. In 2023, U.S. demand for Canadian exports sustained more than 2.6 million Canadian jobs and nearly 17% of GDP.[3]

As part of its strategy to strengthen internal markets, the federal government introduced the One Canadian Economy Act (Bill C-5), which received royal assent on June 26. The legislation establishes mutual recognition of provincial and territorial standards for goods, services and professional certifications, enabling pan-Canadian mobility for businesses and workers. It also streamlines federal approvals for infrastructure projects deemed in the national interest, cutting approval timelines from five years to two.

Currently, interprovincial and territorial trade accounts for over $530 billion annually, roughly 20% of Canada’s GDP. By harmonizing standards, regulations and credential recognition across jurisdictions, the government anticipates improved labour mobility, increased competition and higher productivity. The Canadian Chamber of Commerce estimates that removing internal trade barriers could boost Canada’s annual economic output by up to $200 billion. [4] Accordingly, provinces such as Nova Scotia, Ontario, and Manitoba have introduced or amended legislation to align with the new federal framework.

Inflation and Monetary Policy Trends

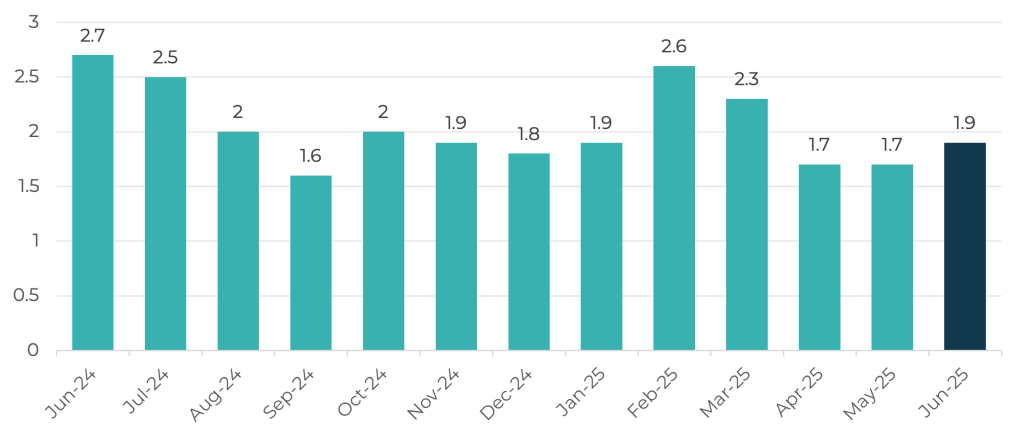

Canada’s annual inflation rate fell from 2.3% in March to 1.7% in April 2025, largely due to the federal government’s elimination of the consumer carbon tax at the start of April.[5] On June 4, the Bank of Canada said it would maintain its benchmark interest rate at 2.75% following a previous cut from 3.0% in March. The Bank will continue monitoring Canada’s core inflation, trade dynamics and labour market indicators ahead of its next rate decision on July 30.

Figure 1: Annual Inflation Rate in Canada (%), June 2024-June 2025[6]

Labour Market Highlights: June 2025

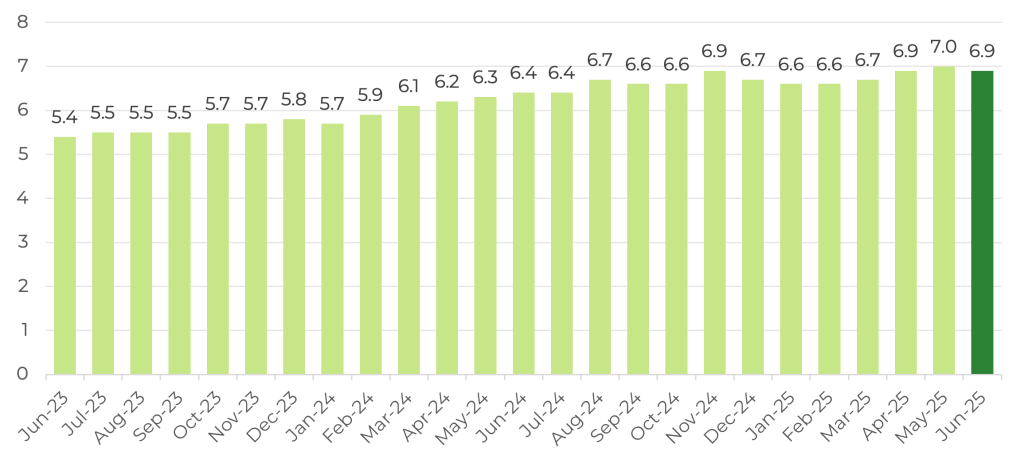

Between May and June 2025, the Canadian economy added 13,500 full-time and 69,500 part-time positions. This is the largest employment gain in six months. The labour force grew by 61,100, reaching 22.61 million, while the seasonally adjusted unemployment rate fell from 7.0% to 6.9%.

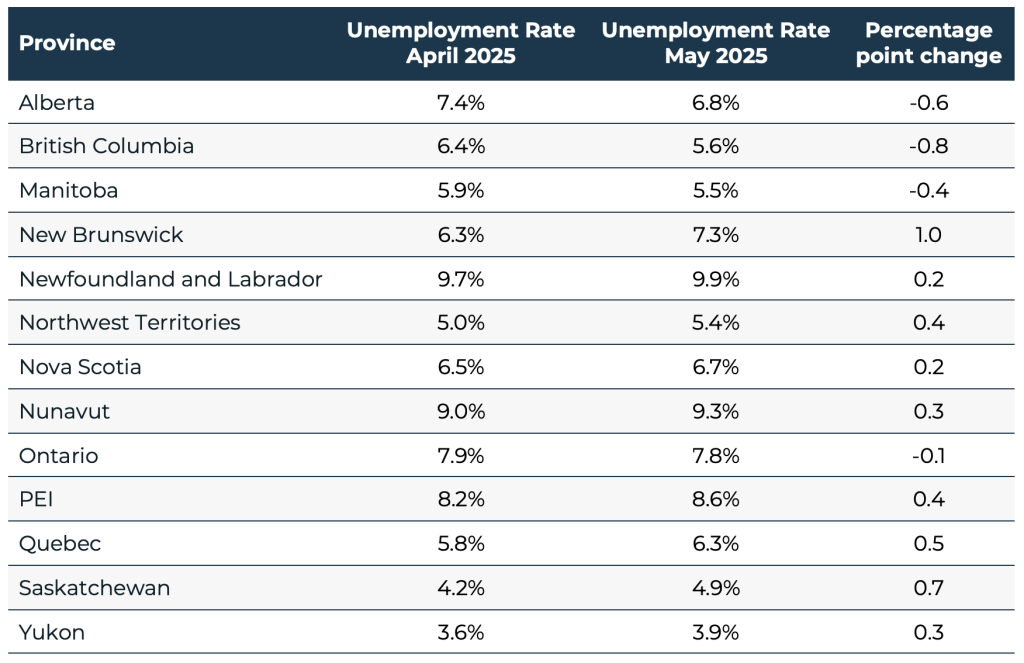

Unemployment rates across the provinces and territories ranged from 9.9% in Newfoundland and Labrador to 3% in the Yukon (see Table 1). In June, 1.6 million Canadians were unemployed, up 9% on a year-over-year basis.

Job seekers are facing longer periods of unemployment. In June, more than one in five unemployed Canadians (21.8%) had been seeking work for 27 weeks or longer, up from 17.7% in June 2024. Student job seekers are facing the highest June unemployment rate since 2009.

Figure 2: Unemployment Rate (Seasonally Adjusted) in Canada (%), June 2023-June 2025[7]

Table 1: Unemployment Rate by Province and Territory, May 2025 and June 2025 (Seasonally Adjusted)[8]

Unemployment by Age, Gender and immigration Status

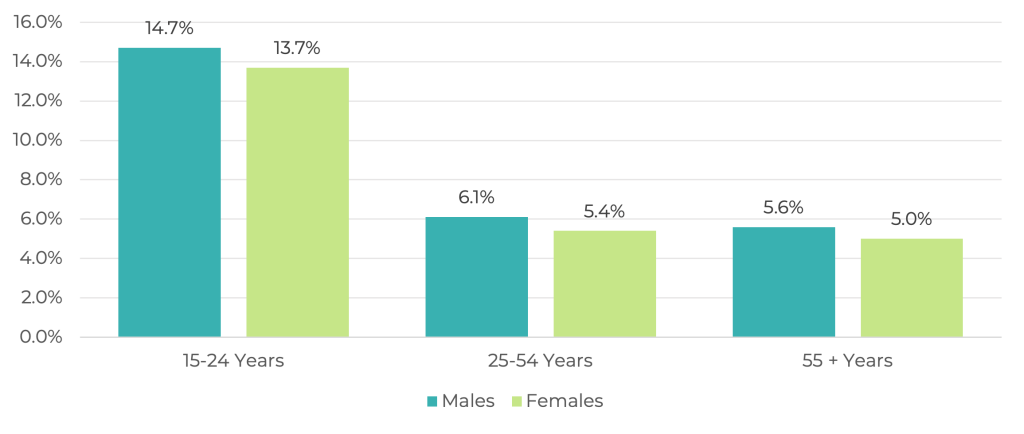

Unemployment rates in June 2025 (illustrated in Figure 3) varied across demographic groups:

- Youth (15-24 years): 7% for men (down from 14.9%) and 13.7% for women (up from 13.4%)

- Core working age (25-54): 6.1% for men (down from 6.2%) and 5.4% for women (down from 5.7%)

- Older workers (55+): 5.6% for men (down from 5.8%) and 5.0% for women (up from 4.7%)

- Recent immigrants (within 5 years): 9%, down from 11.1% in May

Figure 3: Unemployment Rate (%) by Age Group and Gender (Canada), May 2025 (Seasonally Adjusted)[9], [10]

Utilities Sector: Employment and Wages

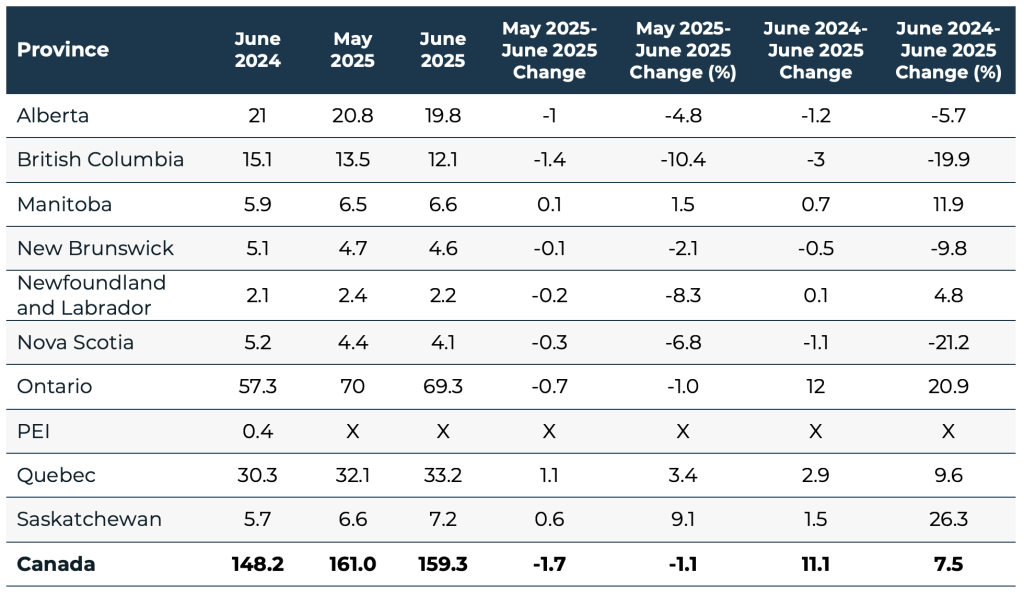

Employment in Canada’s utilities sector declined by 1.7% (on a seasonally adjusted basis) from May to June 2025, down from 161,000 to 159,300 jobs (Table 2).[11] The sector’s unemployment rate rose to 2.5%, up from 1.6% in May.[12] According to EHRC’s research conducted in 2023, the vast majority of the sector’s employees (approximately 110,600) work in the electricity sub-sector.[13]

The largest employment gains were recorded in:

- Quebec:+1,100 jobs (+3.4%)

- Saskatchewan: +600 jobs (+9.1%)

- Manitoba: +100 jobs (+1.5%)

Meanwhile, the biggest declines occurred in:

- British Columbia:-1,400 jobs (-10.4%)

- Alberta: -1,000 jobs (-4.8%)

- Ontario: -700 jobs (-1%)

Table 2: Utilities Sector Employment (in 000s) by Province, June 2024, May 2025 and June 2025 (Seasonally Adjusted)[14]

*Please interpret these figures with caution, as EHRC has not independently verified their accuracy.

X: suppressed to meet the confidentiality requirements of the Statistics Act

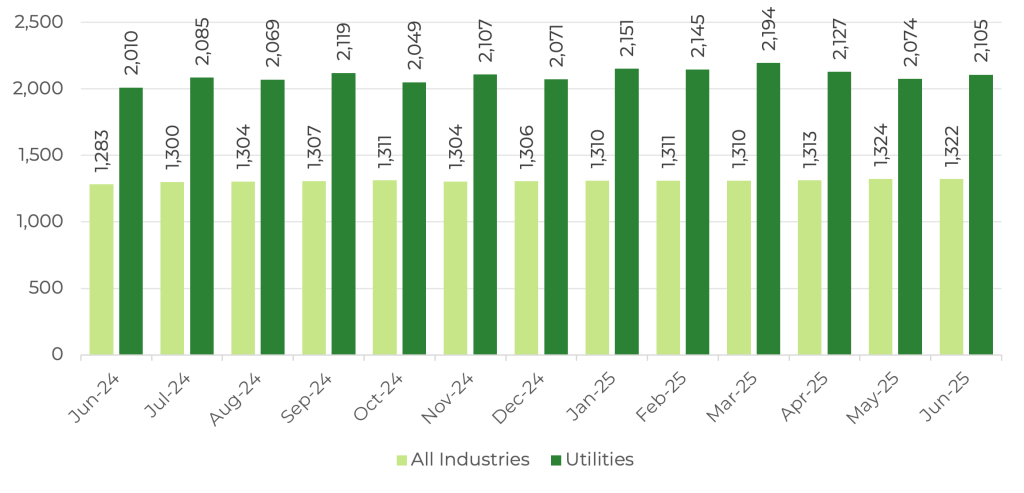

The average weekly earnings in the utilities sector were $2,105 in June 2025—a 1.5% increase from the previous month ($2,074), and a 4.8% increase relative to one year earlier ($2,010), as seen in Figure 4. Economy-wide average weekly wages in June ($1,322) were virtually unchanged from May ($1,313) but were 3% higher than in June 2024 ($1,283).

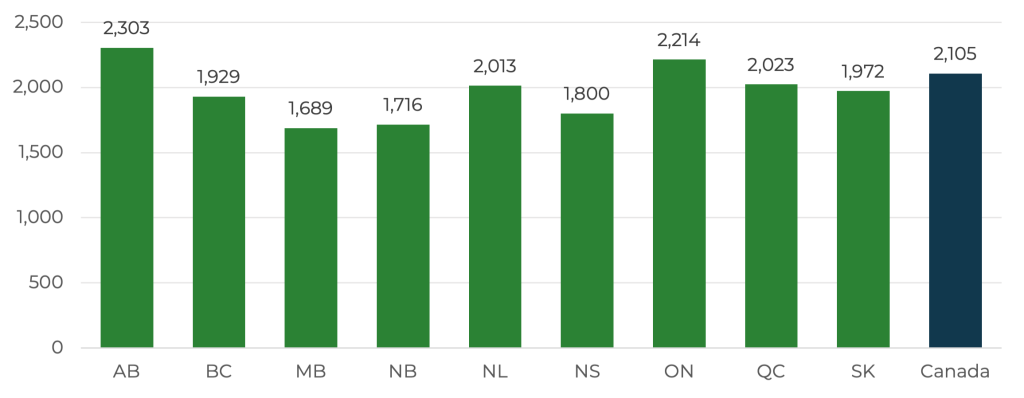

Provincial wage averages in the utilities sector ranged from a high of $2,303 in Alberta to a low of $1,689 in Manitoba, 9.4% above and 20% less than the national average, respectively (Figure 5).

Figure 4: Average Weekly Wage Rates in the Canadian Utilities Sector, June 2024-June 2025[15]

Figure 5: Average Weekly Wage Rates ($) in the Canadian Utilities Sector, by Province, June 2025[16]

Note: Statistics Canada did not provide wage data for PEI for June.

Endnotes

[1] https://www.cbc.ca/news/world/trump-canada-steel-tariffs-1.7548855

[2] https://www.auto123.com/en/news/usa-higher-steel-aluminum-tariffs-auto-industry/72847/

[3] “Impact of tariffs on businesses in Canada: Expectations and strategic responses, second quarter of 2025”, Shivani Sood, June 9, 2025

[4] “B.C. lifts two interprovincial trade restrictions ahead of expected U.S. tariffs; The Globe and Mail (Online), February 28, 2025

[5] “Bank of Canada rate cut odds for June fall after April inflation data”, Canadian Press, May 20, 2025

[6] https://www.bankofcanada.ca/rates/price-indexes/cpi/

[7] Statistics Canada. Table 14-10-0287-01 Labour force characteristics, monthly, seasonally adjusted and trend-cycle

[8] Statistics Canada. Table 14-10-0287-01 Labour force characteristics, monthly, seasonally adjusted and trend-cycle

[9] https://www150.statcan.gc.ca/n1/pub/14-20-0001/142000012018001-eng.htm

[10] Statistics Canada. Table 14-10-0287-03 Labour force characteristics by province, monthly, seasonally adjusted

[11] Statistics Canada. Table 14-10-0355-01 Employment by industry, monthly, seasonally adjusted and unadjusted, and trend-cycle, last 5 months (x 1,000)

[12] Statistics Canada. Table 14-10-0022-01 Labour force characteristics by industry, monthly, unadjusted for seasonality

[13] “Electricity in Demand: Labour Market Insights 2023-2028”, EHRC, 2023

[14] Statistics Canada. Table 14-10-0355-01 Employment by industry, monthly, seasonally adjusted and unadjusted, and trend-cycle, last 5 months (x 1,000)

[15] Statistics Canada. Table 14-10-0063-01 Employee wages by industry, monthly, unadjusted for seasonality

[16] Statistics Canada. Table 14-10-0063-01 Employee wages by industry, monthly, unadjusted for seasonality