October 2025 Labour Market Snapshot

Monthly update on the labour market in Canada’s electricity sector

The latest

Canada’s economy continues to feel the effects of the trade conflict

Against a backdrop of persistent uncertainty and trade disruptions, the Canadian economy continues to soften. Exports fell in the second quarter of 2025, pulling GDP lower and increasing slack in the labour market—meaning more people are looking for work than there are jobs. Businesses are also facing higher costs as supply chains adjust to the reconfiguration of global trade and domestic production. This price increase is anticipated to have an offsetting effect on inflation from weaker economic growth, keeping inflation close to its 2% target.

To support growth, the Bank of Canada cut its key interest rate by 25 basis points, bringing it down to 2.25% on Oct. 29.

Employment gains continue

For the second month in a row, employment grew strongly in October. The Labour Force Survey reported +67,000 jobs, bringing the two-month total to +127,000, enough to offset losses from the end of the summer (-106,000).

The unemployment rate fell to 6.9% (from 7.1%), and nearly 1 in 5 unemployed people found work in October.

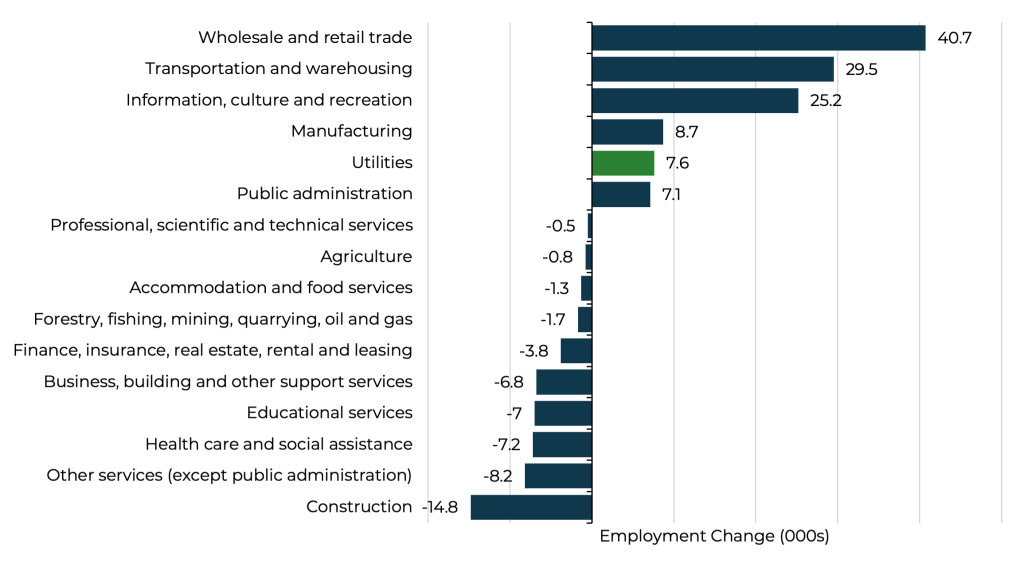

More people were working in wholesale and retail trade (+40,700), transportation and warehousing (+29,500) and information, culture and recreation (+13,000).

Employment change by industry, October 2025

What’s happening in electricity?

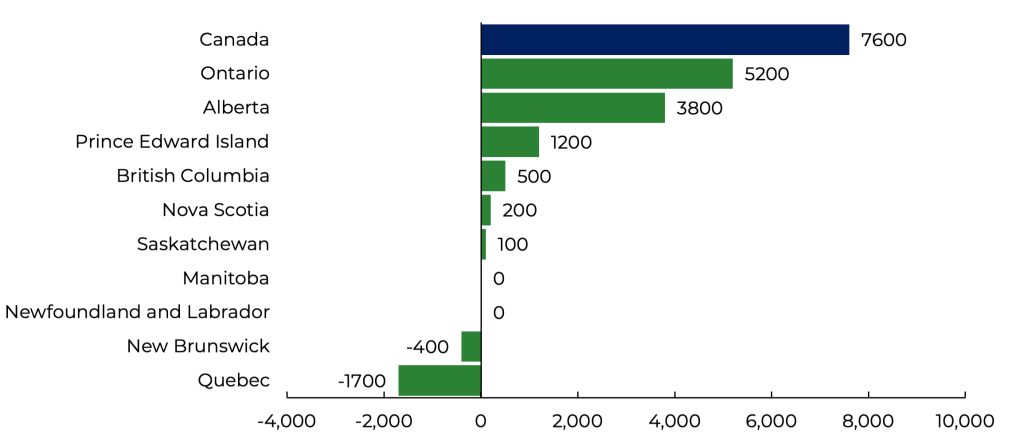

Employment in the utilities sector rose by 7,600 jobs, reaching an estimated 173,100 people working in the sector, a 15.8% increase compared to October 2024.

The year-to-date change in employment for the sector is +17,300 jobs.

Where the growth happened:

- Ontario: +5,200

- Alberta: +3,800

- Smaller gains in PEI (+1,200), Nova Scotia (+200) and Saskatchewan (+100).

- Declines in Quebec (-1,700) and New Brunswick (-400)

Monthly employment change by province, October 2025

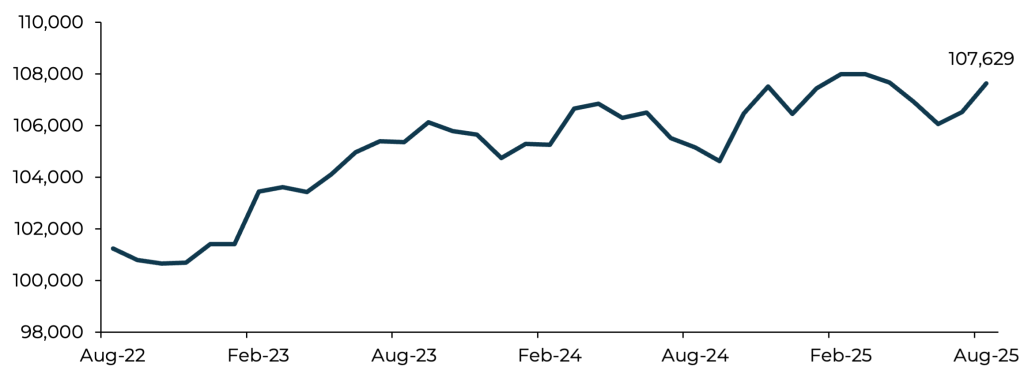

Looking specifically at electric power generation, transmission and distribution, payroll employment reached 107,629 in August 2025, an uptick by 1,116 jobs, according to the latest available data from the Survey of Employment, Payrolls and Hours (SEPH).

Note: SEPH counts only paid employers. It excludes business owners, partners, self-employed workers, unpaid family members, military personnel, people working outside Canada, and casual workers without a T4 form. It also excludes anyone who received no pay during the reference period (e.g., on strike, on unpaid leave, or covered by insurance or workers’ compensation).

Payroll employment for electric power generation, transmission and distribution, seasonally adjusted

Signs of a softer labour market

While employment is growing, other indicators show more people competing for fewer jobs:

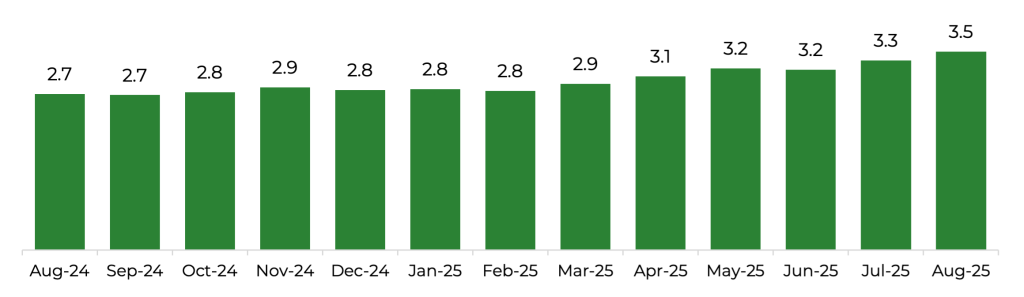

- Across the economy, there are now 3.5 job seekers for every open position, up from 2.7 in August 2024 and 3.3 in July 2025.

- Job vacancies in utilities have been trending down for two years, reaching 1,720 in July 2025.

- The vacancy rate in utilities is 1.3%, relative to an average of 1.7% average over the past two years.

Unemployment to job vacancy ratio