The Potential Impact of U.S. Tariffs on Canada’s Electricity Sector

Exploring economic, policy and operational impacts, and outlining strategies to build a more resilient, future-ready sector.

Overview

EHRC has prepared an assessment examining how U.S. tariffs could affect Canada’s electricity sector and its workforce. This report outlines the economic, policy and operational impacts of these measures and explores strategies to strengthen the sector’s resilience.

Published June 11, 2025

Jump to Section

- Background

- Government Response

- Current Electricity Trade

- Consumer Impact in the U.S.

- Industry and Workforce Implications

- Strengthening the Sector and Workforce

Background

On April 4, 2025, the United States imposed a 25% tariff on Canadian imports not covered under the Canada–United States–Mexico Agreement (CUSMA), which has been in effect since July 1, 2020. Despite contravening CUSMA, the Trump administration also enacted tariffs of 25% on automotive and steel products and 10% on energy and aluminum products. These tariffs on steel and aluminum rose to 50% on June 4, 2025. The measures have drawn criticism from stakeholders across both countries, including those in the electricity sector.

International trade is a key component of Canada’s economy, accounting for two-thirds of GDP and supporting one in six jobs. With 75-80% of Canadian exports historically destined for the U.S., the tariffs are expected to reduce economic output, employment and the value of the Canadian Dollar.

Government Response

Canadian governments responded swiftly. As of April 9, 2025, the federal government imposed reciprocal tariffs on $60 billion worth of U.S. goods. However, following the April 28 federal election, Prime Minister Carney’s newly elected minority liberal government announced a six-month deferral on tariffs for 97% of the initially targeted U.S. products. This move aims to de-escalate tensions and give Canadian industries time to adjust their supply chains.

According to Statistics Canada’s latest survey on business conditions:

- Nearly one in five (18.1%) businesses expect a high impact from U.S. tariffs

- 4% expect a medium impact

- 5% expect a low impact

- 9% expect no impact

- 1% are uncertain

The most affected sectors include transportation and warehousing (40.4%), manufacturing (38.5%), and agriculture, forestry, fishing and hunting (34.7%).

To mitigate the impact, the federal government has pledged to expand Canada’s multilateral trade relationships and eliminate interprovincial and territorial trade barriers in areas where it has jurisdiction by July 1, 2025. More than $530 billion of goods and services, or 20% of Canada’s GDP, are traded annually between provinces and territories. The government estimates that the unimpeded flow of capital, labour, goods and services across provincial and territorial boundaries could boost Canada’s GDP by $200 billion.

To support businesses adversely affected by the U.S. tariffs, provinces have implemented several measures, including tax deferrals, tax reductions and direct aid. Federally, enhancements to the Employment Insurance system include:

- Higher regional unemployment thresholds

- Elimination of the waiting period

- Broader eligibility

Provinces and territories have also restricted U.S. firms from participating in local procurement. For example:

- Ontario: Barred U.S. firms from bidding on contracts with Ontario Power Generation, Independent Electricity System Operator (IESO) and the broader public sector

- Quebec: Introduced a 25% penalty on bids from U.S. firms not currently operating in the province

- Saskatchewan: Proposed restrictions on U.S. bidders for government contracts

- Nova Scotia: Limited U.S. access to provincial procurement and is reviewing existing agreements.

Current Electricity Trade

Canada’s electricity trade is primarily with the U.S., not between provinces and territories. All provinces except Nova Scotia, PEI and Newfoundland and Labrador are connected to the U.S. grid. Canada has consistently exported more electricity to the U.S. than it imports over the last 20 years, driven by the latter’s high consumption rates and stringent state-level environmental regulations.

Hydro-rich provinces like Quebec and Manitoba dominate this trade. While each country imports about 2% of its electricity from the other, Canada exports about 9% of its electricity to the U.S. Over two dozen U.S. states import Canadian power via 35 transmission lines across eight states.

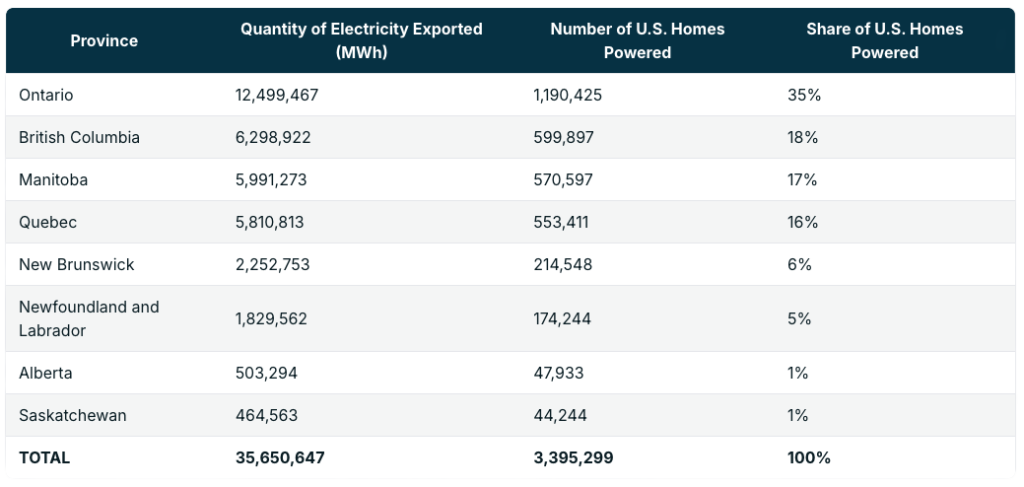

In 2023, British Columbia imported 16.8 TWh of electricity from the U.S. due to droughts that reduced its hydroelectric capacity. In 2024, Ontario, British Columbia and Manitoba exported nearly 25 million MWh—enough to power 2.36 million U.S. homes. Some exports are sold below cost; between 2016 and 2020, up to 9% of Ontario’s exports were priced below production costs.

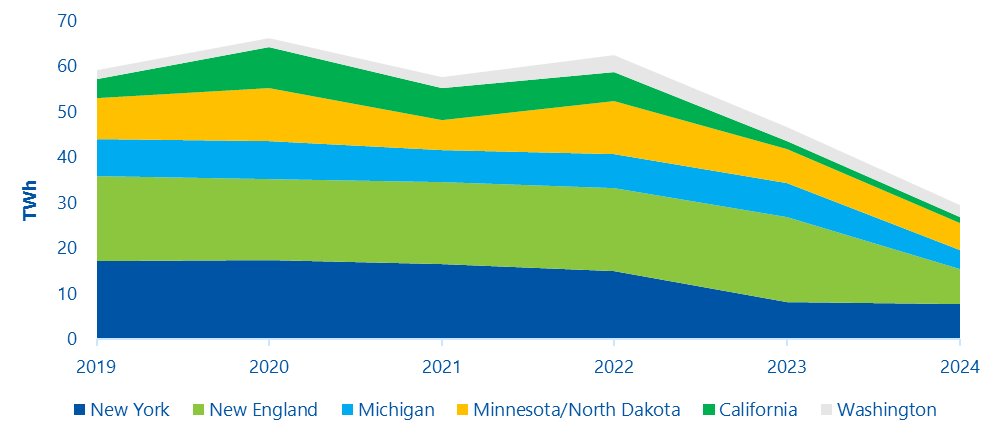

Exports declined from 65 TWh in 2022 to 49 TWh in 2023 and 30 TWh in 2024, while their value fell from $5.8 billion to $2.6 billion. In 2024, Canadian electricity powered approximately 3.4 million U.S. homes.

Table 1: Electricity Exported to the U.S. and Homes Powered (2024)

(Source: RBC)

Figure 1: Electricity Exports to Select U.S. Regions

(Source: Power Advisory LLC)

Following the imposition of U.S. tariffs, Ontario, Manitoba, Quebec and British Columbia considered reducing their electricity exports to the U.S. On March 10, 2025, Ontario’s Premier announced a 25% surcharge on electricity exports to the U.S., but suspended it the next day. Had it remained, it would have affected about 1.5 million U.S. households and businesses in New York, Michigan and Minnesota, costing them about $400,000 per day.

The impact of U.S. tariffs on electricity imported from Canada is unclear. If the U.S. had imposed a 25% tariff between 2019 and 2022, the total cost would have ranged from $629 million to $1.5 billion. A 10% tariff would have cost $250 million to $580 million. On a per-MWh basis, this equates to $9-$22/MWh.

Consumer Impact in the U.S.

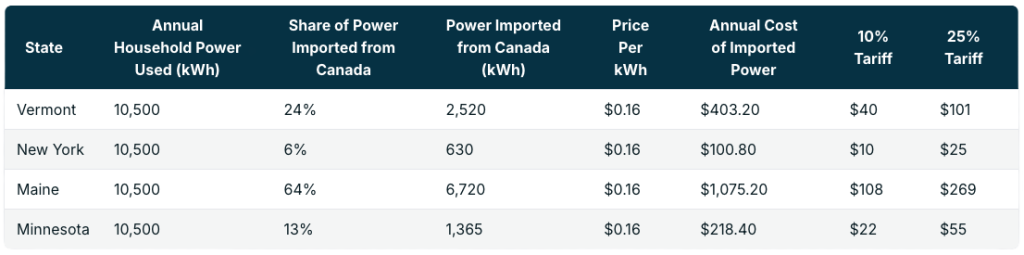

The financial impact of tariffs on U.S. consumers depends on several factors: tariff rate, electricity price, household consumption and the proportion of the tariff that is borne by consumers. Our analysis assumes:

- The average U.S. residential electricity price (2025) is $0.16/kWh

- The average household consumption is 10,500 kWh/year

- A full cost pass-through to consumers

The analysis shows that households in border states that rely heavily on Canadian electricity, particularly rural or colder states such as Maine and Vermont, would bear the brunt of tariff-induced price increases.

The estimated annual household cost (US$) of tariffs on electricity imports from Canada in selected U.S. states would be:

- Maine: $108 (10% tariff), $269 (25% tariff)

- Vermont: $40 (10%), $101 (25%)

- New York: $10 (10%), $25 (25%)

- Minnesota: $22 (10%), $55

If tariffs applied only to generation costs, actual costs could be 40% lower. According to the U.S. Energy Information Administration, generation costs accounted for 61.6% of the total cost of electricity in 2023, whereas distribution and transmission comprised 26.3% and 12.1%, respectively.

Table 2: Estimated Annual Household Cost of Tariffs in Selected U.S. States (US$)

(Sources: U.S. Chamber of Commerce, Vermont Public, American Public Power Association, RBC, U.S. Energy Information Administration)

Industry and Workforce Implications

Electro-Federation Canada (EFC), representing over 230 organizations in Canada’s electrical and automation sector, warns that even a 10% retaliatory tariff on electrical products imported from the U.S. could hinder Canada’s ability to meet its power needs. A recent EHRC survey of employers in the electricity sector found that many respondents are concerned about rising costs and grid reliability due to tariffs on essential U.S.-made components. These costs could worsen energy affordability, especially for low-income and rural Canadians.

While firms are exploring obtaining components from suppliers in Europe and Asia, EFC supports tariffs on U.S. energy products as a necessary step to ensure fair competition and protect Canadian jobs. A Nanos survey found that 75% of Canadians supported taxing energy exports to the U.S. if tariffs on Canadian products persist.

Strengthening the Sector and Workforce

To enhance grid resilience and support decarbonization, Canada’s electricity sector would benefit from:

1. Eliminating Interprovincial Trade Barriers

Making it easier for electricity companies to access materials, equipment and expertise, enabling them to source components and knowledge from the most cost-effective or technologically innovative suppliers. Removing barriers would streamline the delivery of clean electricity from low-emission provinces (like Quebec, Manitoba and British Columbia) to fossil fuel-intensive jurisdictions.

2. Standardizing Training and Certification

Promoting labour mobility for skilled workers (such as electricians, technicians, lineworkers and engineers) to enable them to move more freely across the country, and expanding the Red Seal program to align apprenticeship recognition across jurisdictions.

3. Aligning Training for Unregulated Roles

Developing National Occupational Standards for emerging roles (such as wind turbine technicians, solar installers and solar designers), and the introduction of accreditation programs for training institutions to improve consistency and mobility. EHRC has piloted an accreditation program for training institutions to meet the national standard for these roles.

Greater harmonization of training and certification processes will reduce project costs and timelines required to complete interprovincial projects (such as grid integration and infrastructure upgrades) while enhancing the reliability and stability of the electricity system. This will help Canada reduce its dependence on fossil fuels and support its long-term goals of decarbonization and electrification.

These measures will support the timely construction and maintenance of east-west transmission lines and accelerate the development of renewable energy projects, delivering environmental, economic and public health benefits for Canadians.